Value Investing in the Age of AGI

Introduction

Most people who write about AI and investing fall into one of two camps: traditional investors who see the high valuations of AI stocks and say it’s a bubble;1 or AGI-pilled investors who will buy AI stocks at any price, regardless of fundamentals. There’s only a tiny intersection of people who understand that AGI is not a normal technology while also recognizing that fundamentals matter.

I’m not an expert (or even a journeyman) on AI or fundamental analysis, but I do know a little bit about both.

The basic thesis of value investing is that the market over-rates expected future growth and under-rates present-day fundamentals. Stocks that are poised to benefit from AGI tend to be growth stocks—people have high expectations for them, and they’re priced expensively relative to present-day fundamentals. That suggests that we shouldn’t buy AI-related stocks.

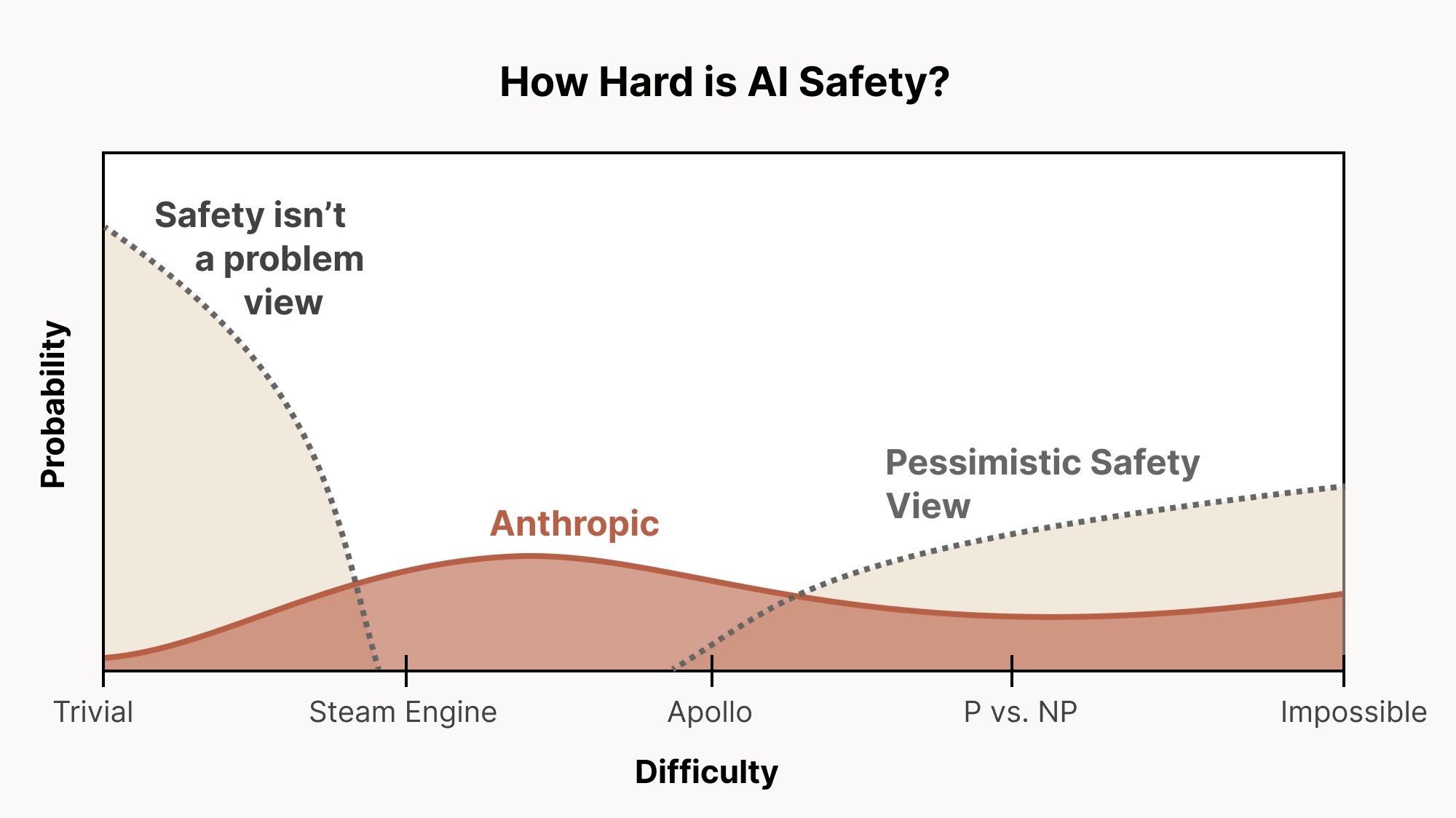

At the same time, the market does not appear to expect AGI, which suggests we should buy them. Which of these two forces is stronger?

My current thinking is that value investing probably won’t work in light of AGI, but there is some reason to believe it might work even better; and value investing is a useful hedge in case AI progress slows.

Continue reading